Many leave the neighborhood for their banking needs

As Janeka Coker reflects on the struggles of opening up her business on South Salina Street, she laughs and exhales a deep sigh.

“So far we’ve put our own money in, and it takes a lot. It’s a little bit of a struggle,” Coker said.

Her full-service hair salon, Miraculous Beauty, has been a long time coming. She spent several years working at another salon before deciding to open her own. Her new salon is part hair revolution and part neighborhood therapy for young girls that she mentors while they’re there.

Coker is working with Bank of America in downtown Syracuse to help finance her new business. “I’m in the process right now of getting a small business loan.”

She’s decided to go with a bank outside of the neighborhood for several reasons. “I have a history with them, and it’s a little bit easier.”

For quite some time the South Side was seen as a “food desert,” a community without a major grocery to serve residents. A Tops market recently opened.

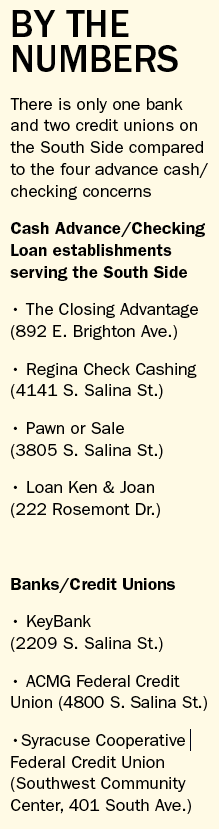

It’s been a “banking desert” as well: There’s only one bank on the South Side.

Don Dutkowsky, economics professor at the Maxwell School at Syracuse University, said some of the reasons banks are cutting back or moving out of low-income areas have to do with government regulations.

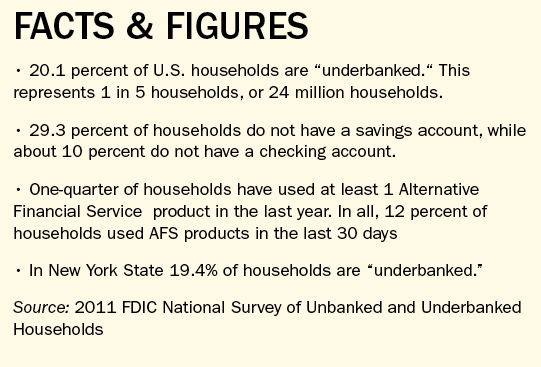

Regulators have placed restrictions on fees for overdrafts, which had been a big moneymaker in struggling neighborhoods. Residents in the area who typically get by on low or moderate incomes are unable to qualify for bank accounts due to no credit or bad credit, or they’ve previously mismanaged their accounts, Dutkowsky said.

“Banks don’t view it as profitable in terms of the clientele as potential deposit holders, or borrowers in terms of loans they would give out,” Dutkowsky said. He added that the South Side is being greatly underserved by banking institutions. “The real problem with people in poverty in this country is the lack of banking association and the lack of banking knowledge,” he said.

Homeowners who need help are also struggling. “We have people calling us every day to try and find some way to finance real serious home repairs. Someone facing a real serious repair that may or may not result in them having to leave their home,” said Phil Prehn, community organizer for Syracuse United Neighbors. The S.U.N. group has been advocating for people on the South Side for more than three decades.

According to Prehn, one of the main reasons people in the area aren’t able to get loans is because there aren’t any banks willing to give them access to credit. The banks are operating out of “fear,” he said, and are unwilling to tap into all markets.

“We’ve always talked about how there’s a market here and they just don’t believe it,” Prehn said.

According to City-Data, the average house on the South Side is valued at about $85,000, a figure that could not be enough to convince banks to invest.

Vincent Cobb travels 10 minutes away from his South Side home any time he needs to go to the bank and has been doing so for the past 20 years. As long as he’s been living in the area, he can only remember there being a single bank, Key Bank, on the corner of South Salina and East Colvin. “I think it would be nice to have a variety of banking options,” Cobb said.

There are several ways residents in the area could benefit if they had multiple banks available, he said.

“They could offer small business loans, they could offer a place for people to go to get home loans and car loans,” Cobb said. He banks with a Summit Federal Credit Union that’s close to his job and meets most of his requirements, except location.

Without everyday banking needs being met from traditional banks, non-traditional banking institutions pop up in economically challenged areas.

They can be expensive alternatives that sometimes steer people into unwanted transactions that will not benefit them in the long run. This might include a for-fee check-cashing center, payday loan provider or pawn shop that charges to cash checks or offers expensive short-term loans, according to a research brief for the Metropolitan Policy Program at Brookings. The research brief also explains that nationally, moderate- and low-income households pay over $8 billion in fees to non-bank, check-cashing and short-term loan providers — services a customer could have taken advantage of for less or no cost at a bank. The South Side has four of these alternative-banking options compared to only one traditional bank, Key.

The Stand

The Stand