The Syracuse Housing Authority aims to increase homeownership with 50 new homes

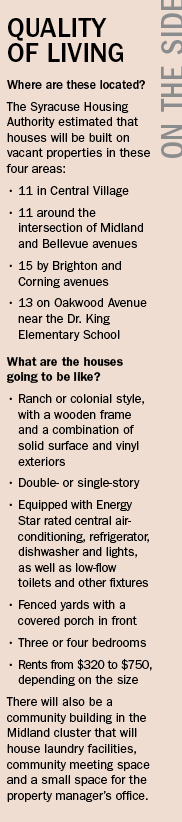

This upcoming spring, the Syracuse Housing Authority will begin yearlong construction of 50 homes for low-income families on the South Side. The program aims to increase homeownership in the city while also filling its many vacant lots.

At least five of the homes will be designed for the physically disabled, including some for the visually or hearing impaired.

The homes will go to those whose income falls between 30 percent and 60 percent of Onondaga County’s median annual income, which depends on the family’s size; currently, for a family of four, that ranges between $16,800 and $33,600.

The selected tenants will participate in what the SHA calls a “lease-purchase” program. For the first 15 years, tenants will lease the properties at rents ranging from $320 to $750 a month. Then, in 2027, the houses will be made available for the renters to purchase for the homes’ appraised values. To help people do that, part of the rent over the years will go into an escrow account that will help pay for the mortgages.

The selected tenants will participate in what the SHA calls a “lease-purchase” program. For the first 15 years, tenants will lease the properties at rents ranging from $320 to $750 a month. Then, in 2027, the houses will be made available for the renters to purchase for the homes’ appraised values. To help people do that, part of the rent over the years will go into an escrow account that will help pay for the mortgages.

The Stand spoke with Bill Simmons, executive director of the Syracuse Housing Authority, on what impact the SHA hopes the program will have on the South Side, who it is looking for and how people should apply.

Q&A with Bill Simmons

The Stand: Why start this program on the South Side?

Bill Simmons: Two reasons. First, it has the greatest needs. The previous homes that were demolished over the past 10 years on the South Side created a sort of gap-toothed appearance in many neighborhoods. And then also because, since the Housing Authority is going to manage these properties for the first 15 years, it makes sense to be geographically close to where our operation is located.

TS: Why clusters of houses?

BS: We’re trying to have the greatest impact on the neighborhood. And what we’ve learned from the city’s Department of Neighborhood and Business Development is that the best way to have that impact is to focus on a concentration of homes. So we are working on clusters — or, as we call them, “nodes” — where we could put 10 to 15 houses and really have an impact on the neighborhood.

TS: Who are you looking for to participate in the program?

BS: People who are looking for long-term housing, individuals who are stable and don’t move around a lot, who’ve been in their jobs for long periods of time — we’re looking for that kind of stability. But also individuals who maybe today could not go out and purchase a home because they may want some time to clean up their credit and get some down payment savings and take some of the homeownership classes that we’re going to require through Home Headquarters. It’s an individual who wants to get in on a brand-new home, is in no rush to move and enjoys living on the South Side. This program falls apart if we don’t find individuals committed to buying the homes.

TS: How can people apply?

BS: The process is not narrowed down yet, but we are developing a waiting list from the individuals who call. What we’re going to do is weigh the factors for future tenants as you would any other property: a lot of it’s going to be based on income and how long you’ve been at your job, your interest in being on the South Side, references from your current landlord — those kinds of issues, those typical indicators that are important for any landlord.

TS: Why must tenants wait 15 years to buy the homes?

BS: This is an IRS tax credit program that is administered by the state. Every project that these tax credits fund, there are certain benefits that the investors receive that will last 15 years. So these properties have to be available to the tax credit investors for the 15-year time period. I know a lot of people take exception, saying, “Well, I’ve got to wait 15 years before I can purchase it,” but that’s how the program is structured. The good news is that if you’re leasing the house to buy it, you build up equity over that time so that X amount of your dollars will be set aside as escrow, leading to the purchase of the home.

TS: Who will maintain the properties for 15 years?

BS: It will be the Syracuse Housing Authority, but hopefully there won’t be a lot to maintain. The homeowners will likely be responsible for smaller stuff like mowing their lawn. We will also have a property manager to make sure that they keep the homes the way they should. And what you have to realize with this tax credit program is that not only do you have the Housing Authority looking at the investment, but you have the investors and New York state too. You’re going to have a lot of people looking at these houses to make sure they’re kept the right way.

TS: Say that after the 15 years has ended, the renters either do not want or simply cannot afford to purchase the homes. What happens then?

BS: They can continue renting for however long they wish. And we expect that out of the 50 homes there might be one or two people who want to be long-term renters, but it won’t undermine the general goal of creating more homeowners. … The goal is not to have people rent, but you can’t help it if people change their minds.

TS: Will people who decide not to purchase the homes get their escrow money back?

BS: No. At that point, they would just be considered as a regular person who rented the home. The escrow only goes to the individuals who are ultimately going to buy the home. That’s part of the incentive.

The Stand

The Stand